Bank of Japan

View:

May 16, 2024

France and Japan: Debt Fuelled Growth Problem

May 16, 2024 10:30 AM UTC

Most of the surge in debt/GDP in Japan and 40% in France is due to higher government debt and this should not be a binding constraint provided that large scale QT is avoided – we see the ECB slowing QT in 2025 and are skeptical about BOJ QT in the next few years. The adverse impact of higher deb

April 26, 2024

April 25, 2024

BoJ's Intervention and its impact

April 25, 2024 6:24 AM UTC

In the period of time when JPY significantly weakens or strengthens, BoJ will intervene in the FX market either through verbal or actual intervention. As JPY weakened significantly in the past months, once again we found ourselves in the proximity of FX intervention with unknowns for anonymity is ke

April 22, 2024

BoJ Preview: Showing no hurry

April 22, 2024 6:13 AM UTC

Our central forecast is for the BoJ to remain on hold for interest rate and signals the market they are in no rush to further tighten while allowing trend inflation data to lead policy direction in their forward guidance. BoJ has moved interest rate to 0% and officially removed YCC in March, citing

March 25, 2024

Japan Outlook: Beginning of A New Era?

March 25, 2024 4:54 AM UTC

Bottom Line:

Forecast changes: We revised 2024 GDP lower to +0.8% from +0.9% because private consumption is now expected to contract in Q1 2024. 2024 CPI is revised higher to +2.1% from +1.7% to address the stronger wage hike Japanese unions secured.

March 22, 2024

March 19, 2024

March 13, 2024

BoJ Preview: 50-50

March 13, 2024 3:17 AM UTC

Our central forecast is for the BoJ to change forward guidance in March, indicating trend inflation will be achieving target and ultra-ease monetary policy is no longer necessary and hike interest rate to 0% in April as wage growth has accelerated and the latest wage negotiation is likely to ensure

March 12, 2024

Japanese Equities: Yen Headwind Rather than Tailwind

March 12, 2024 11:23 AM UTC

Bottom Line: Japanese equities tailwind from a weak JPY boosting corporate earnings will likely go into reverse, as the extreme JPY undervaluation ebbs with small BOJ rate hikes and Fed easing. We also forecast less nominal GDP growth in 2024 and 2025 than the market consensus. As this come thro

January 23, 2024

January 18, 2024

Japan: 10yr JGB Yields set to Rise Moderately

January 18, 2024 10:15 AM UTC

The more subdued profile of Japanese wages, plus a delay in the 1st BOJ hike, has prompted us to lower the forecast of a rise in 10yr JGB yields in 2024 – though we still see a rise above 1% (Figure 1). As BOJ tightening stops, we see 10yr JGB yields falling back again in 2025.

January 15, 2024

BoJ: The Pace of Exit

January 15, 2024 5:41 AM UTC

The BoJ has kicked the can down to the spring wage negotiation before another step in monetary policy. While current inflation forecast has exceeded BoJ's 2% target in all three items of headline, ex fresh food and ex fresh food & energy, the wage growth did not reach a "sustainable" level, which Ue

December 19, 2023

BoJ Review: Waiting Till Spring Wage Negotiation

December 19, 2023 9:26 AM UTC

To our surprise, not only the BoJ did not aggressively bring rates to zero percent, they did not even change their forward guidance. Given the latest inflation dynamics, it is surprising BoJ would not seize the time to hint a change of monetary policy. Yet, if BoJ only want to wait for the perfect m

Preview: BoJ to Announce New Forward Guidance

December 19, 2023 12:00 AM UTC

The BoJ meeting on December 18-19 is going to announce a change in forward guidance by suggest BoJ will be ready to exit ultra-loose monetary policy as trend inflation is in close sight of 2% target. Some hawkish market participants maybe anticipating an immediate hike from the BoJ to bring rates to

December 15, 2023

DM Rates Outlook: Front End Favored

December 15, 2023 10:19 AM UTC

• EZ debt yields will also see a swing back towards a positive shaped yield curve. Gradual ECB rate cuts will translate into a persistent decline in 2yr yields in 2024, but slower in 2025 as the market will be uncertain about the terminal policy rate and the ECB forward guidance will like

September 28, 2023

DM Rates Outlook: Peaking Policy Rates and Less Yield Curve Inversion

September 28, 2023 7:16 AM UTC

Risks to our views: A mild recession in the U.S. would lead to larger than projected Fed easing in 2024, which would bring yields down across the curve – though still with disinversion occurring. The spillover would impact government bond yields in other DM countries except Japan.

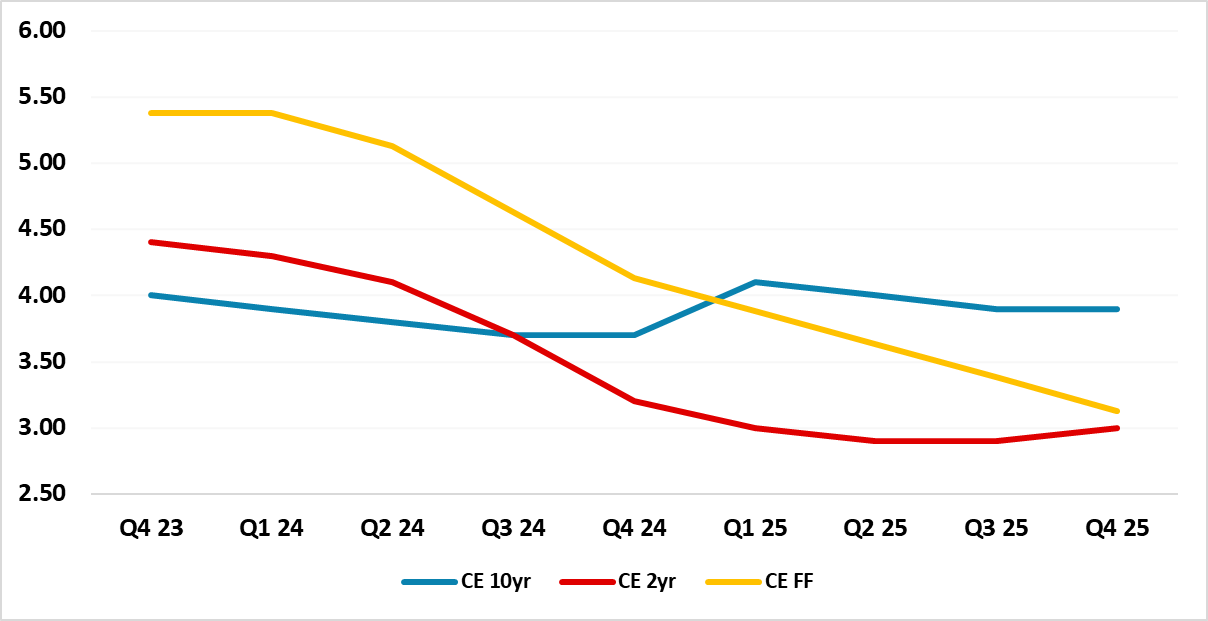

Figure 1: U.S.

September 27, 2023

Japan Outlook: The First Step to Exit

September 27, 2023 6:00 AM UTC

Macroeconomic and Policy Dynamics

Japanese headline inflation has been moderating for 2023 so far, as global supply chains swing back to normal and energy prices rotates lower before the recent bounce. However, the pace of moderation has been hindered by stronger food prices (record chicken culling o

September 04, 2023

DM Government Bonds Diverging

September 4, 2023 9:31 AM UTC

As DM policy tightening nears a peak, 10yr government bond spreads are starting to diverge.What is driving this and how much further can they diverge?

Figure 1: 10yr U.S. Treasury-Bund Spread and Fed Funds-ECB Depo Rate (%)

Source: Datastream/Continuum Economics

U.S. Soft Landing and EZ/UK Recess

June 22, 2023

DM Rates Outlook: Yield Curve Inversion to Ebb

June 22, 2023 1:03 PM UTC

• In the U.S. we see inflation in the remainder of this decade being closer to 2.5% than 2.0% and also see higher real yields than the 0.45% that existed between 2015-19 (we see 2020’s supply problems, QT and inflation uncertainty meaning higher real yields). This means that nominal 10yr yield

June 21, 2023

Japan Outlook: Trend Inflation To Remain Below 2%

June 21, 2023 10:05 AM UTC

Macroeconomic and Policy Dynamics

The easing of supply chain restraints, lower energy price and global tightened financial condition has led to Japanese headline inflation moderation. However, CPI ex Fresh Food & Energy has been unfazed by aforementioned factors and continuously rose in H1 2023.

March 27, 2023

DM Rates Outlook: Peak Rates and Yield Curve Steepening

March 27, 2023 1:45 PM UTC

Risks to our views: A moderate U.S. recession on larger than expected tightening of financial conditions could bring forward Fed rate cuts and prompt a downward shift in 2yr yields, but similar yield curve steepening between 10-2yr.

Figure 1: U.S. Treasuries Fed, Funds, 2yr and 10yr Yield Forecasts (

February 22, 2023

In-Depth Research: Quick Roadmap Central Bank Forecast/Rationale - February 2023

February 22, 2023 10:44 AM UTC

M/T Quick Roadmap – Fundamental MMKT/CB Roadmap and Rationale

February 2023

US FEDERAL RESERVE

The February 1 December FOMC meeting saw the pace of tightening slowed to 25bps. Inflation has slowed, but January's CPI details still show broad based inflationary pressures at a pace well above the Fed's

January 18, 2023

BOJ Review: BoJ stays dovish

January 18, 2023 5:53 AM UTC

The BoJ meeting on 18th December was widely expected to have little change to their monetary policy but market participants would be closely watching its forward guidance as some are speculating for any signals of an early exit from ultra-loose monetary policy. There were headlines crossing the wire

January 13, 2023

Money Supply Squeeze

January 13, 2023 1:26 PM UTC

While we are eclectic on money supply relationship with growth/inflation, but it cannot be ignored and the recent sharp deceleration warrants investigation in the U.S. and Eurozone.

Figure 1: U.S./China/Eurozone M2 Growth (Yr/Yr %)

Source: Datastream/Continuum Economics

Slow U.S. and EZ Money Suppl

July 06, 2022

Government Bonds: Inflation or Slowdown Risk?

July 6, 2022 2:36 PM UTC

Figure 1: G4 10yr Government Bond Yields (%)

Source: Datastream, Continuum Economics

Government Bonds Become Two-way

The one-way upward surge in DM government bond yields has finished for now, and government bond yields are torn between high inflation and slowdown/recession risks (Figure 1). The rece

June 17, 2022

DM Rates Outlook: Yield Rise to Slow

June 17, 2022 10:44 AM UTC

Figure 1: 10yr U.S. Treasury Forecasts to end-2024 (%)

Source: Continuum Economics

How Much Fed Tightening and the Yield Curve

We are of the view after the June 15 FOMC meeting that the Fed will likely tighten by 75bps in July, 50bps in September and 25bps in November to a 3.00-3.25% Fed Funds target

Japan Outlook: Is This the 2% Japan Craved?

June 17, 2022 10:11 AM UTC

Our Forecasts

Source: Continuum Economics

Risks to Our Views

Source: Continuum Economics

Macroeconomic and Policy Dynamics

2022 is going to be a rare year when Japanese GDP and inflation are both above 2%. Our forecast of 2.1% growth reflects the rebound of private consumption after the rolling states of